13-Week Cashflow Planning: Shaping Business Strategies

Living in a time where cash is undeniably king, even highly profitable companies can face cashflow challenges that have ripple effects throughout their operational departments. From payroll struggles to contract breaches and even business closures, the impact of poor cashflow is far-reaching.

To mitigate these risks, businesses are now placing greater emphasis on cashflow forecasting. However, traditional long-term planning spanning years may not provide the agility needed in today’s climate. Instead, the focus has shifted to the next few months, making 13-week cashflow forecasts a vital tool for financial stability.

The essence of 13-week cashflow forecasts lies in their short-term nature, allowing businesses to develop operational plans that accurately project immediate cash needs. By drawing insights from recent past data, these forecasts offer superior accuracy compared to longer-term plans. Notably, businesses with creditors and debtors often operate within payment terms of under 90 days. This implies that orders taken or made in the last few months have a direct impact on the cash movements within the forecasted period.

Applied to the current business landscape, a 13-week forecast takes into account the evolving circumstances and market dynamics, ensuring preparedness for potential challenges and opportunities. It encompasses factors such as market fluctuations, industry trends, and operational contingencies. Whether it entails managing staff furloughs during uncertain times, allocating resources for strategic initiatives, or determining the appropriate budget for capital expenditures (CapEx), the forecast plays a crucial role in optimising cash utilisation and supporting the overall financial health of the organisation.

Many companies opt for the assistance of advanced software solutions such as IBM Planning Analytics or Anaplan to streamline the process of creating their financial plans. These tools offer flexibility in generating integrated models, automating budgeting and forecasting, and facilitating collaboration among multiple users with diverse areas of expertise. IBM Planning Analytics and Anaplan provide businesses with the necessary tools to enhance the accuracy and efficiency of their financial planning processes.

Shifting the curve

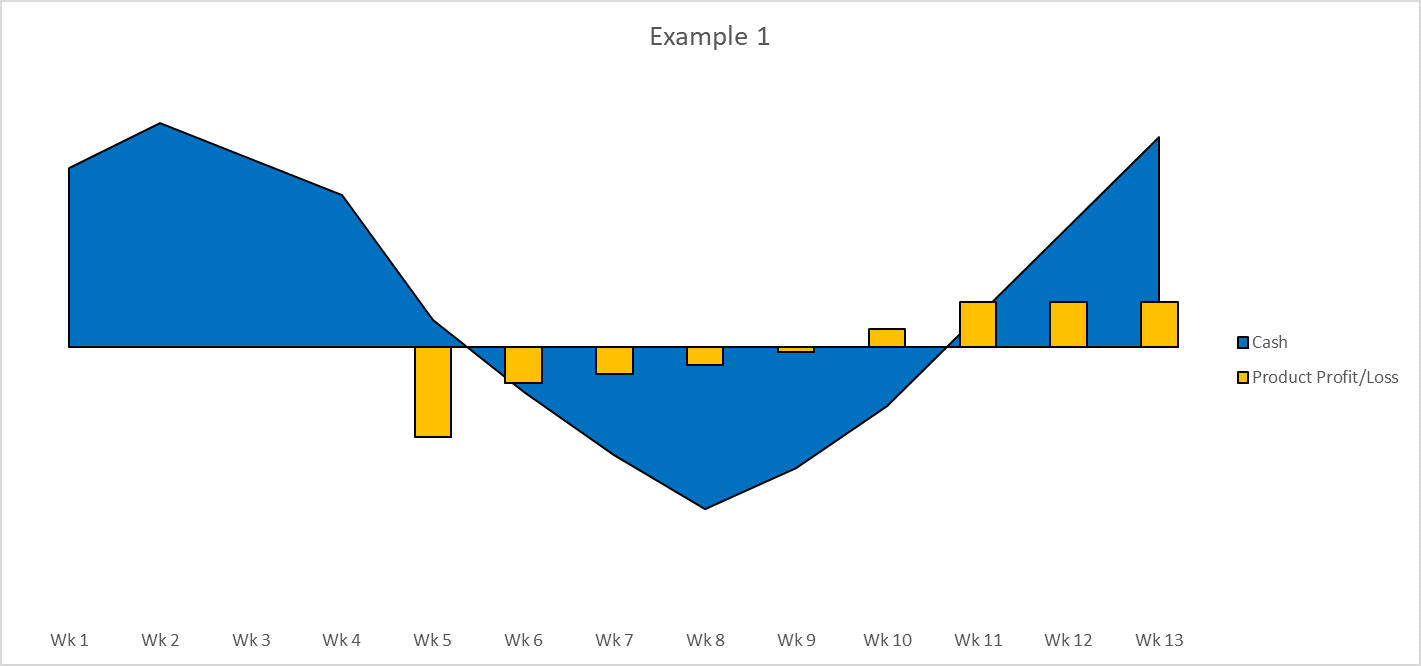

Having an accurate 13-week cashflow could drive major business decisions, such as whether to launch a new product in this period. If the product is assumed to make an initial loss before making money several weeks later, then launching it at a time when revenue is low and cash is tight could result in negative cash, as seen below.

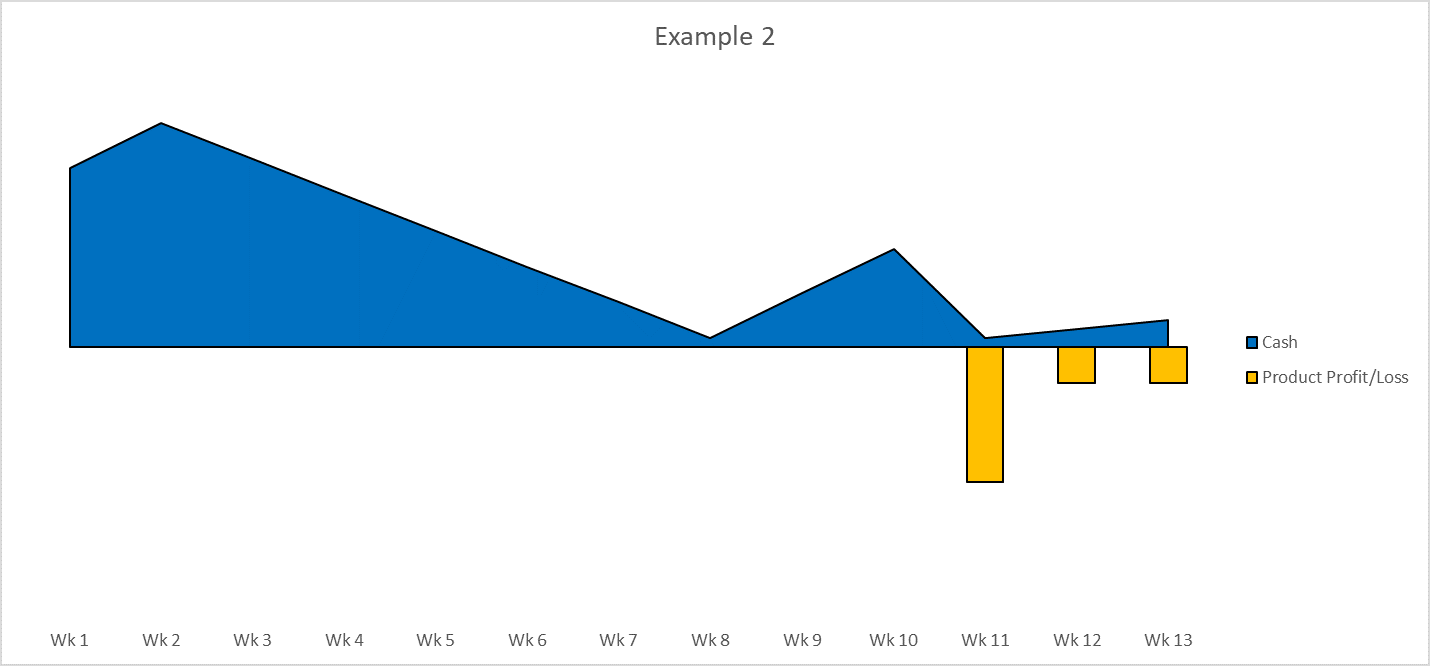

If, however, the date of the product launch is moved back to a time when cash is flowing back into the business more freely, then a negative cash situation can be avoided. This applies even if the cost of the product launch is greater as a result of the delay, as in the second chart below.

Effective scenario planning

Comparing the impact of a new product’s launch date change is a concrete example of scenario planning. It involves contrasting a scenario forecast with a baseline forecast, highlighting the effectiveness of tools like IBM Planning Analytics and Anaplan. These tools possess remarkable capabilities in facilitating such comparisons, empowering businesses to make informed decisions based on their forecasted scenarios.

By constructing an integrated model that connects various elements such as profit and loss statements, balance sheets, operational data, and workforce planning, among others, businesses gain the ability to instantly observe the downstream effects of forecast driver changes. This means that even a minor adjustment, such as altering the date of a product launch, can result in automatic shifts in associated revenue and costs throughout the entire model. This seamless connection enables organisations to assess the comprehensive implications of their decisions in real-time and make well-informed choices accordingly.

For instance, IBM Planning Analytics and Anaplan both operate on an in-memory platform, ensuring that any modifications to the model yield instant results. This capability not only enables swift responsiveness but also enhances scalability, allowing businesses to incorporate additional details or data for improved accuracy. By integrating customer-level sales data, organizations can apply individual payment terms, resulting in more precise operational cashflow projections. They empower businesses with the flexibility and tools to refine their forecasting processes and make informed decisions based on reliable and comprehensive insights.

Planning Analytics also has built-in sandbox functionality which can be utilised to create a safe space to amend forecasts and compare them to baseline. When reviewing forecasts the graphical workbook tool ‘Workspace’ provides drag and drop functionality to create informative charting and KPIs so that changes can be easily visualised.

Anaplan has been built from the ground up to be highly intuitive both from modelling and reporting perspectives. The new UX reporting tools allow the super-user to build their own interactive dashboards plus remove the need for manipulation of data into MS PowerPoint for month-end board packs with the use of management reports within Anaplan which offer the slide show experience over real-time connected reporting.

All in all, building and maintaining a 13-week cashflow forecast at this time is vitally important, and employing a market-leading analytical tool to do the hard work will speed up every step of the process.

About the Author

Rob Tindall is a skilled Planning Analytics consultant with extensive industry experience and a deep understanding of analytical solutions. With a solid background in utilising tools like IBM Planning Analytics/TM1, Anaplan, SPSS, and other analytical platforms, Rob brings a diverse skill set to his consulting work.

Rob thrives on the versatility and complexity of his projects. Collaborating with clients across diverse sectors such as Insurance, Retail, Hospitality, and Finance, he has developed custom solutions to address a wide range of business challenges. From optimising budgeting and forecasting processes to enhancing product and customer profitability and streamlining workforce planning, Rob consistently delivers exceptional results.

Rob is also proficient in various programming languages, enabling him to seamlessly integrate solutions into clients’ existing systems. However, what truly sets him apart is his unwavering commitment to continuous learning. Rob approaches each project with genuine eagerness, constantly acquiring new skills and staying up-to-date with the latest advancements in the field.

With his extensive experience and exceptional expertise, Rob is widely recognised for his ability to provide outstanding solutions and invaluable consultative advice to clients. As a highly sought-after expert in the industry, he consistently surpasses expectations, helping organisations optimise their business performance through innovative solutions.