Why 13-week Cashflow Forecasting is so popular

We are now living in a time when cash is undoubtedly king. Even very profitable companies can have problems with cashflow in the current climate, and poor cashflow can have all kinds of knock-on effects. Companies could struggle to pay staff, break contract terms with suppliers, breach statutory rules, or even go out of business entirely.

The possibility of these scenarios becoming a reality has caused many businesses to look more closely at their cashflow forecasts. But instead of long-term planning of 5 or 10 years ahead, we should be focusing on the next few months, which is where 13-week cashflow forecasts are important.

As the name suggests, these are short-term operational plans of cash in the business. They help to forecast the immediate future, driven from data in the recent past, resulting in much better accuracy than a longer-term plan. Businesses with creditors and debtors largely have payment terms of under 90 days, which means that orders taken or made in the last few months will translate directly into the cash movements of the forecasted period.

Applied to the present-day situation, a 13-week forecast would include the various phases of the government’s post lockdown plan and cover the period of time staff might be furloughed. Should the business be lucky enough to be cash-rich and not need to consider such extreme measures, then the forecast could help determine how much cash would be available for potential acquisitions, CapEx expenditures, or even goodwill gestures for the staff or beyond.

Many companies choose to use software such as IBM Planning Analytics to assist them in producing their plans. IBM Planning Analytics is a flexible way to produce integrated models to automate budgeting and forecasting and provide collaborative tools so that multiple users can bring their area of expertise.

Shifting the curve

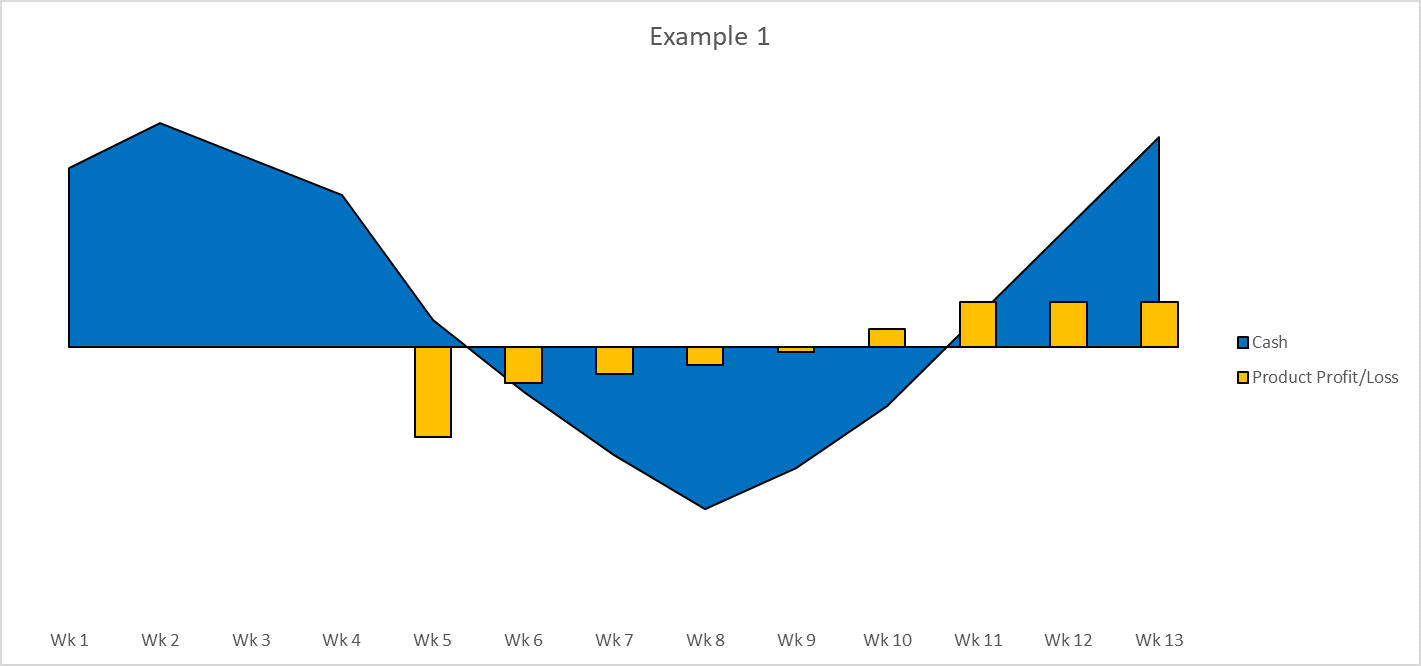

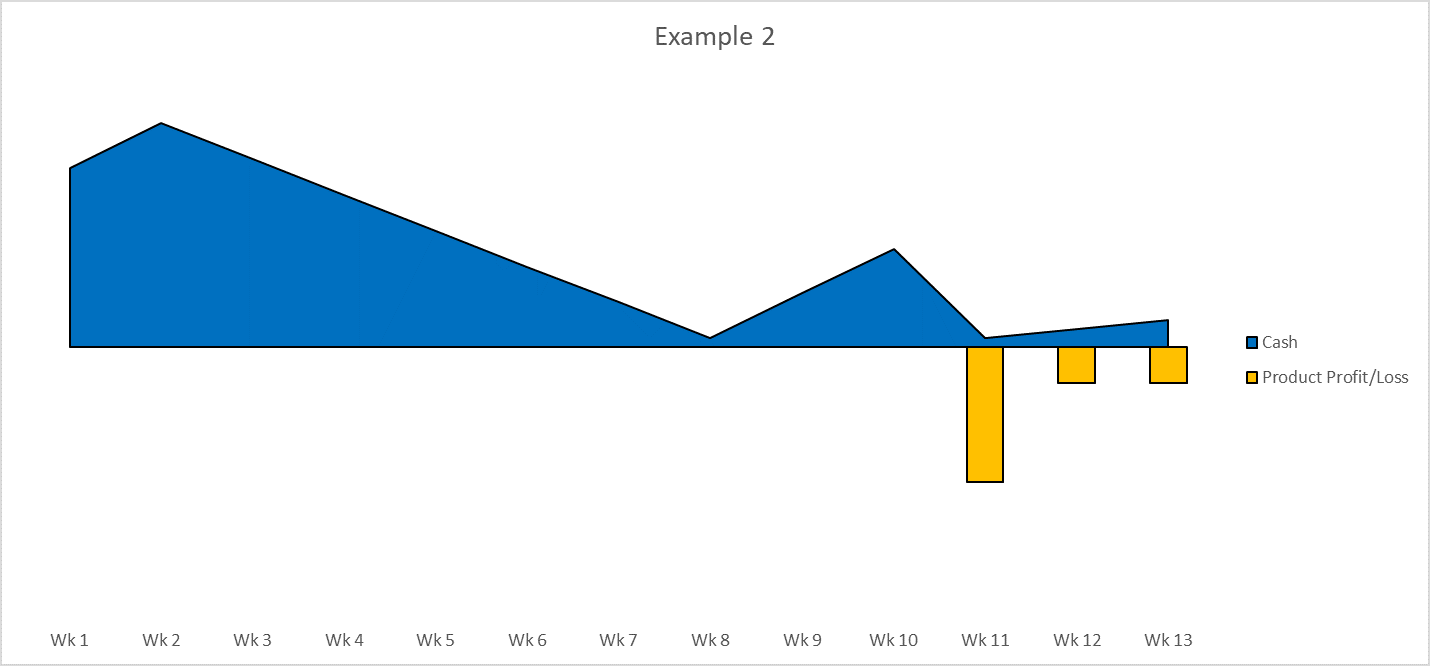

Having an accurate 13-week cashflow could drive major business decisions, such as whether to launch a new product in this period. If the product is assumed to make an initial loss before making money several weeks later, then launching it at a time when revenue is low and cash is tight could result in negative cash, as seen below.

If, however, the date of the product launch is moved back to a time when cash is flowing back into the business more freely, then a negative cash situation can be avoided. This applies even if the cost of the product launch is greater as a result of the delay, as in the second chart below.

Effective scenario planning

Comparing the effect of a change in the launch date for a new product is an example of scenario planning. This is where a change in a scenario forecast can be compared to a baseline forecast and is where tools like IBM Planning Analytics are particularly powerful.

If an integrated model is built, linking some or all of profit and loss statements, balance sheets, operational data, and workforce planning, amongst others, then the downstream impact of changes to forecast drivers can be seen right the way through the model instantly. The result of the scenario example above could be achieved by simply changing the date of a product launch, with all associated revenue and costs shifting automatically.

IBM Planning Analytics runs in memory meaning any changes will give instant results. This also makes the model very scalable, so bringing in additional detail or data to help with accuracy is possible. This could include integrating customer-level sales data to apply individual payment terms and get more accurate operational cashflow.

PA also has built-in sandbox functionality which can be utilised to create a safe space to amend forecasts and compare them to baseline. When reviewing forecasts the graphical workbook tool ‘Workspace’ provides drag and drop functionality to create informative charting and KPIs so that changes can be easily visualised.

All in all, building and maintaining a 13-week cashflow forecast at this time is vitally important, and employing a market-leading analytical tool to do the hard work will speed up every step of the process.